Why Can’t Americans Cover Unexpected Medical Expenses?

Although many Americans carefully plan their expenditures and a good number of US consumers have taken the extra step of planning, and sticking to, a budget, most are unprepared for unexpected medical bills. Any type of home appliance or automotive emergency can wreak havoc on your budget, and many homeowners even set aside part of their budget to accommodate.

Although many Americans carefully plan their expenditures and a good number of US consumers have taken the extra step of planning, and sticking to, a budget, most are unprepared for unexpected medical bills. Any type of home appliance or automotive emergency can wreak havoc on your budget, and many homeowners even set aside part of their budget to accommodate.

Unexpected Medical Expenses

When it comes to medical emergencies, however, more than half of Americans do not have an appropriate amount of funds set aside for even the most basic medical emergencies. What are the most common reasons for this situation?

The Amount in Savings Isn’t Enough

One problem is that the paychecks of many US consumers are barely covering household expenses. Whether this is the result of poor financial planning or simply low-paying jobs, there are many Americans who struggle to make ends meet between paychecks.

Medical savings may be one of the last things on their minds as they determine which bills to pay and when. The problem may be exacerbated if those Americans are underinsured or have no insurance at all.

Expensive Healthcare Costs

Of course, the cost of medical procedures is another part of the problem. Extended hospital stays, high-cost medications, and emergency room visits will quickly take healthcare bills into the thousands of dollars.

Other expensive factors of healthcare costs include high numbers of testing procedures to determine a single diagnosis, hospital billing errors, and a lack of standardization when it comes to pricing for procedures. Also, most patients do not have access to those procedure prices. Consumers can make price comparisons before they choose a spot to vacation, but aren’t able to do so before they head in for surgery.

The High Costs of Insurance

The lack of affordable medical insurance also contributes to Americans’ struggle to pay for unexpected healthcare expenses. In fact, just a few years again, almost half of the adults in the US did not have reliable health insurance.

Prompting this situation are increased costs of healthcare insurance premiums that outpaced increases in income during the same time period. Combine the high cost of health care with the inability to purchase insurance and many American consumers find themselves in the position of not having the means to pay for medical expenses.

Borrowing From Peter to Pay Paul

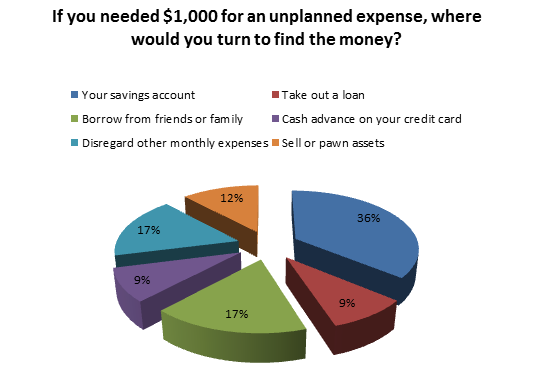

What do Americans plan to do if they are faced with emergency medical bills? Just over a third of consumers in the US feel that they have enough stashed away in their savings to pay for a visit to the emergency room; that’s at least a start.

What do Americans plan to do if they are faced with emergency medical bills? Just over a third of consumers in the US feel that they have enough stashed away in their savings to pay for a visit to the emergency room; that’s at least a start.

Others say that they will have to cut back spending in other areas of their budget and some plan to borrow money – either from friends, family, or credit cards. One way or another, most of these people will still end up with hospital and doctor bills that they cannot afford to pay. If their injuries or medical conditions have led to the loss of work for any amount of time, then the situation may be even more serious.

What Happens When Americans Can’t Pay Their Medical Expenses?

Today, most consumers in the US have mounting medical debts. Some of these are fortunate enough to have worked out affordable payment plans. Unfortunately, there are large numbers of Americans with debts that have gone to collections.

Category: Health, Medical Insurance