Tag: tax deduction

Tax Savings For Having Domestic Workers

A household employer is someone who hires people to perform duties around the home, such as nannies, gardeners, maids, private nurses, cooks, etc. They are considered employees or domestic workers when this is their main profession and you control their hours, services, supplies, etc. These domestic workers differ from independent contractors, such as construction workers […]

Getting Your Taxes Done is Easy with the Right Software

Surprisingly, Americans lost out on $1 billion in 2014 by submitting their own income tax return. Maybe you’ve watched the commercials showing an impressive warship or football field depictions of the amount of cold, hard cash we wasted by taking our monetary future into our own hands. Nevertheless, before these fear-mongering advertisements trigger you to […]

Tax Tricks You Should Know for the Upcoming Season

Taxpayers who lament receiving small refund checks every year may not be doing all they can in terms of smart tax planning. While you can’t control what the IRS does, you can, in many cases, control the size of your next tax refund check. So, how do you go about it? Paying attention to the […]

Property Investment: best way in which you can save for your retirement

The property market has always been seen as an excellent way of saving for retirement. Houses are solid, long lasting structures which usually appreciate in value. Investing in property will provide either a nice one-off lump sum or can provide a regular monthly income. When it comes to getting started in property investment there are […]

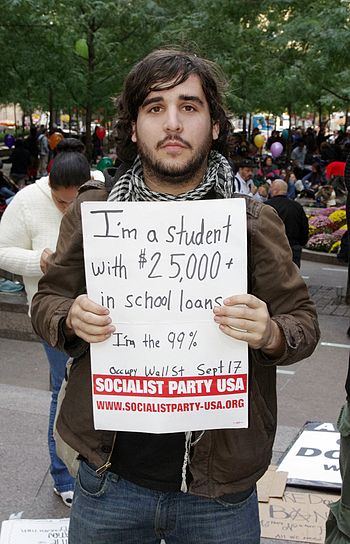

5 Big Tax Breaks That All College Students Should Know About

Saving money in college is a big deal. Whether you’ve managed to nab scholarship funds, your parents are helping you out, you’ve taken out student loans, you work a part-time job, or all of the above, money is likely to be a little tight during your years in college thanks to the high cost of […]

Six Things You don’t want to Forget to Include in your Annual Tax Return

Tax time is quickly approaching, and it’s important to get your paperwork in order long before the April 15th deadline. Make sure that you have all the receipts you need in one place now so that you aren’t scrambling to find it when you are filling out the forms. Filling out the forms as accurately […]

Prudent Tax Information-Tax Deductible Business Expenses

To have your tax information prudently done is very important. By the same token, to know the tax deductibles will help to lower your tax burden. It is possible to claim a number of expenses tax-free that will go a long way in alleviating your tax problems. The area of tax is very dicey and […]

Why do you need a tax attorney?

Doing your own taxes is a tedious task. Many who venture out to complete this activity often find themselves confused and defeated by the sheer complexity of the task. Most of the time people give up and thus end up paying more taxes than they should in the first place. With the busy schedules that […]

5 Tax Advantages from Oil and Gas Investments

The biggest advantage of investing in oil and gas exploration directly has always been the ability to profit directly from high energy prices. Expen sive oil tends to mean slower economic growth; therefore, many other investments are down when oil wells are giving their biggest returns. But as beneficial as that type of diversified investment […]

Follow Us!