Tag: Internal Revenue Service

How to Choose the Right Tax Preparer

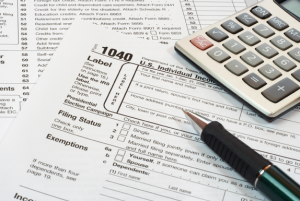

Embed from Getty Images Many taxpayers choose to use a tax preparation service to help them with their taxes each year. Professional tax help is usually smart. These individuals understand the laws and codes governing how much tax you should actually pay. In addition, outsourcing tax prep allows many people to save time. Since there […]

Don’t Let Tax Issues Ruin Your Finances

As a law-abiding citizen, you might file your tax return each year by April 15. And since you know it’s your responsibility to pay taxes, you might send the IRS a check for any taxes owed. But unfortunately, even if you do everything right, mistakes on your return can result in owing additional taxes. Unless […]

5 Ways To Know You Need Help With Filing Your Taxes

It is not so simple to file taxes. While some small business owners will use a simple program, they are getting the short end of the stick. In fact, when unprepared, a person is more likely to overpay or get audited. That comes with a burden of forms, paperwork, and maybe even fines that you […]

Five Ways You Can Save Money When Filing Your Taxes

A taxpayer should try to find multiple ways to lower his or her tax burden so that he or she can enjoy a better return. Now, most people use the basics and get to deduct a few small expenses. However, to get a decent return and not overpay on taxes, one should follow these five […]

Don’t Make These Five Tax Mistakes

When filing taxes, many make minor errors. When avoiding these top five tax mistakes, one should have no trouble filing a return and avoiding any delays. Math calculations In the computer age, some people still like to file their taxes with a pen and piece of paper. While it is possible to do so without […]

Why do you need a tax attorney?

Doing your own taxes is a tedious task. Many who venture out to complete this activity often find themselves confused and defeated by the sheer complexity of the task. Most of the time people give up and thus end up paying more taxes than they should in the first place. With the busy schedules that […]

Tax 101: How to Determine if You Have Unclaimed Tax Refunds

When it comes to filing your tax, you want to make sure that you have everything right. You can get into serious trouble if you end up making certain mistakes, and therefore it is a good idea to check over it multiple times. Some people will probably give them a day or two to look […]

How to Choose a Qualified Tax Professional

If you are looking to find a Tax Preparer for your Tax Return, then you should carefully analyze some criteria before making a decision. License: As per the law, only CPAs, Enrolled Agents, or IRS approved Tax preparers can file your tax return. When you talk to the Tax professional, ask them if they are […]

5 Reasons for Expats Giving Up Their American Citizenship

You must have heard the latest buzz about expatriates giving up their US citizenship. The new rule under the Foreign Account Tax Compliance Act states that all financial institutions abroad will have to report if they have an American co-signer. This law is creating a lot of problems and majority of the Americans are of […]

Follow Us!