Tag: Credit rating

What You Need to Know When Applying for Any New Credit or Loan

Applying for any new credit or loan is a stressful experience. You might want or need the money to achieve a crucial financial goal, but you might also be running the risk of rejection or wind up in a bad deal you have to live with for a while. Knowing certain things about this can […]

Tips to Overcome Your Bad Credit Record and Get Installment Loans

Would you be able to stand to assume out a Bad Credit Installment Loan? That is simply the principal thing to ask when you begin to understand a budgetary requirement for money imbuement. Do you have enough nonessential pay left finished each month that you can manage the cost of another regularly scheduled installment? The […]

Common Financial Mistakes

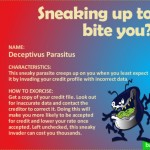

In today’s unreliable economy, more and more people are paying attention to their spending, investing, and long term financial goals. But just because you’re aware of your finances doesn’t mean that you’re not making mistakes. Here are some of the most common mistakes that people make with their finances. Buying Premium Gas Oil companies and […]

5 Ways You Didn’t Know Bad Credit Could Hurt You.

How having bad credit could hurt you in many aspects of life you didn’t know about. If you have bad credit, other than not being able to get a credit card, there are many other things you maybe didn’t know could affect you negatively. Apartment or condo Lease Denied You just located that excellent apartment […]

How Installment Loans Affect Your Credit Score

Are you considering taking out an installment loan but unsure of how it will affect your credit? Installment loans are a different form of credit, and unlike credit cards, your monthly payments do not vary. So you must do something extremely wrong with an installment loan to have an adverse effect on your credit. Most […]

Bad Credit? Six Steps To Get Back On Track Financially

Bad credit can happen to anyone. All it takes is a hectic schedule so that you forget to make timely payments, a period of unemployment, health problems, or an unexpected emergency purchase that disrupts the regular budget. However, there are steps you can take to get back on track financially and avoid debt. No matter […]

Financial Repair: How to Improve Your Credit Ratings

Your credit rating will be reviewed when you apply for credit, when you fill out a rental application or even when you apply for a new job or insurance policy. A lower credit rating can have a negative impact on your life in numerous ways. If you have learned that you have a lower credit […]

Paying Off Your Personal Loan Debt the Easy Way

The feeling of wallowing in debts that are spiraling out of control is an oppressive feeling that many people suffer from. Dealing with debt in a responsible manner is imperative to extricating oneself from such a situation and although it can at times require more personal sacrifice than one might wish for, it’s often the […]

5 Ways To Achieve a Higher Credit Score

We all know how important it is to establish a strong credit rating, as this will enable you to apply for loans, car finance, credit cards and other financial services. Credit rating is essentially a score that goes from o to 1000 and is used by creditors to establish how credible and reliable you are. […]

Follow Us!