Tag: Balance transfer

Personal Loan: The Perfect Fail-Safe During Emergencies

A personal loan can be termed as an emergency fund that gives you access to funds to mitigate sudden incidents/investments that require a lot of money. Tackling these issues with your savings can leave you financially unstable. Personal loans are quick, unsecured, and have a substantial tenure for repayment. There’s no reason to doubt why […]

Dealing With Debt? What You Need To Gain Financial Freedom Again

Being in debt is exhausting. If you’re dealing with debt, you are probably experiencing a high level of stress. However, it’s important to remember that there are ways to deal with your financial problem. The longer you put it off, the more serious your financial situation will become. If you’re ready to start living a […]

5 Ways to Reduce Your Debt Quickly and Effectively

Being in debt is never fun for anyone. I affects your family and you personally. It makes it harder to go out and do the things you want to do or go out to the places you want to go. Most people struggle to get and stay out of debt, but rest assured that getting […]

How to Use 0% APR Credit Cards to Your Advantage

Have you ever been shopping for something and when you checked out they offered you 6 months same as cash financing? That is what 0% APR credit cards offer, except it is for all of the purchases that you make on your card. 0% APR credit cards allow you to make all of the purchases […]

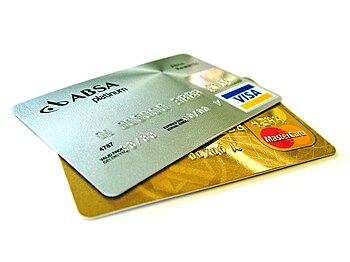

Take a Look at a Balance Transfer Credit Card to Consolidate all of your Credit Card Debt and Save Money

Now that the holidays are over you may be looking at some pretty hefty balances on your credit card statements. And if you are one of the people that took advantage of store branded credit cards then you might also be looking at paying a decent amount of interest as well. But what if […]

Foolproof Tips to Get Permanently Out of Your Harassing Debt

Nowadays, it is not surprising to be trapped into a debt such that it keeps distressing you often as well as burdening your bank balance. Sometimes, the debt keeps on increasing just because the employment of ineffective ways to pay it off. For example, you may end up taking loans to pay an already existing […]

Why Loans Are Better than Credit Cards

You’ve probably heard that loans are a better choice than credit cards, but have you ever wondered why this is so? Most experts are of the opinion that loans are a better choice, which isn’t to say you shouldn’t apply for a credit card for emergencies, but more so that if you’re going to borrow […]

Want To Save Money On Your Credit Card Debts? Here’s How!

These days, credit card debt has become a way of life for many. More people have balances on credit cards today than ever before. Another staggering statistic is that most people spend too much money on their credit card debts! The truth is, there are tons of people out there that qualify for lower interest […]

Follow Us!