Simple Budgeting to Prevent Financial Disasters

Saving money is challenging, particularly if you’ve never been in the habit of putting money away each month. The temptation is always there to clear your bank account after every pay check – the bills are paid and you’re only young once, so why not go have a good time and worry about saving in the future?

Saving money is challenging, particularly if you’ve never been in the habit of putting money away each month. The temptation is always there to clear your bank account after every pay check – the bills are paid and you’re only young once, so why not go have a good time and worry about saving in the future?

While that’s a fun approach, and it will usually work for a while, life has a way of throwing up a few unexpected expenses and if you’re not prepared you could end up in a financial hole that’s difficult to get out of. You end up borrowing money and getting into debt, and before long that extra ‘fun money’ you used to have is being used to cover loan repayments and credit card bills.

Planning for the Future

The key to consistent, effective saving is to put a little money away every month for the expenses you know are coming up eventually. Your car will need serviced and insured at some point in the year, so rather than panicking the month before, you set aside a fraction of the money every single month. That way you have it in your account when you need it.

This applies for every major expense you’re likely to encounter throughout the year – holidays, birthday gifts, home repairs etc. By purposefully putting money away every month you won’t be taken by surprise when the bill arrives.

This applies for every major expense you’re likely to encounter throughout the year – holidays, birthday gifts, home repairs etc. By purposefully putting money away every month you won’t be taken by surprise when the bill arrives.

The same goes for your fun money. Set aside some cash every month that’s just for you. That way you won’t be missing out while you’re putting money aside for the less enjoyable things in life.

Make use of the various instant savings accounts that are offered by most banks. That way your money is working for you, but you have access to it if necessary.

The YNAB Method

There’s a popular budgeting tool called You Need A Budget (often shortened to YNAB) which is ideal for this approach to budgeting and saving. The principle of their budgeting method is simple and is based around 4 rules:

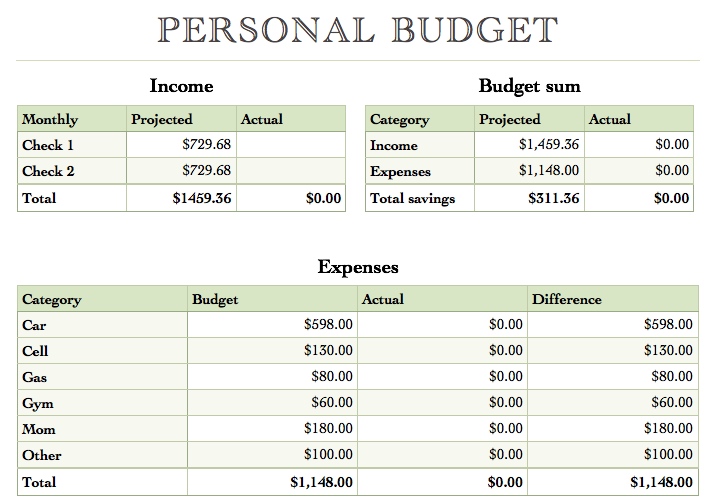

Give every penny a job – make sure everything in your account is for something. By allocating all your money to a specific category you can make sure that you’re working towards your various financial goals.

Save for a rainy day – allocate money for any major expenses due in the future. This can include things like repairs to your car or your house, saving for a trip, building up a deposit for a house or anything which will require an investment outside of your normal expenses.

Make adjustments – Accept that you’re likely to overspend in some categories and make adjustments. Some months you’ll spend more on food or you’ll spend more on leisure activities. Accept it, adjust your budget and move on!

Live on last month’s income – build up a financial buffer to ensure there’s enough money in your account to cover all your expenses before your pay check comes in

It’s a straightforward approach to budgeting which many people have found useful, and it’s a perfect introduction to the world of sensible money management.

Working within a budget every month can take a little getting used to, but you’ll probably find that just being aware of how much is in each category has an influence on the way you spend money. If you know there’s enough money left for you to go for dinner an extra night or pick up a new video game then there’s no reason to deny yourself the pleasure. You can enjoy life safe in the knowledge that your bills are paid and you have savings you can rely on.

Category: Family Finances