Pyramid Schemes – 100% True Investment Fraud

With the economy finally on its way up, investors have been concerned with where to put their money. New investors since 2008 have been hesitant about investment fraud after the surge of get-rich-quick schemes that popped up, and they should be.

There are dozens of investment schemes out there, and all investors should be aware of the basic tactics. Many investment fraud schemes are based on a few basic structures. Among them is the infamous “Pyramid Schemes” which is simple, but often missed.

What Is A Pyramid Scheme?

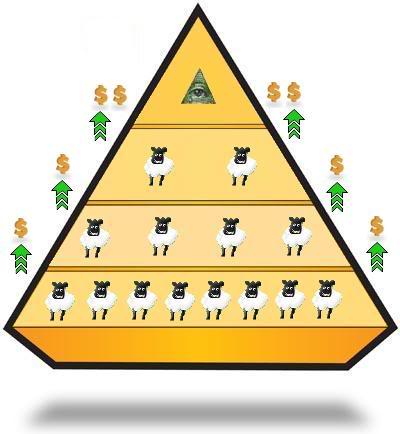

The most simple of investment fraud schemes is the pyramid scheme. This scheme works by having one initial recruiter that recruits someone and has them pay an initial investment; their investment is in turn recouped by recruiting others.

There is no legitimate ‘investment’ made and no service or good being sold.

Why Is This Fraud?

Pyramid schemes are fraudulent because there is no guarantee of return, the system cannot sustain itself. If a person is recruited and pays their investment, but cannot recruit anyone else, then they never receive their promised return.

The cycle cannot be sustained, eventually there is no one else to be recruited to the pyramid and it then crumbles. This type of scheme is illegal in the United States, as well as almost all other developed countries around the world.

Recognizing A Pyramid Scheme

Pyramid schemes come with many cover-ups. You may be asked to purchase or forward something disguised as a donation. If there is no legitimate ‘investment’ being made, into the stock market or otherwise, beware.

Pyramid schemes come with many cover-ups. You may be asked to purchase or forward something disguised as a donation. If there is no legitimate ‘investment’ being made, into the stock market or otherwise, beware.

The same goes for get-rich-quick schemes that don’t seem to involve any good or service of substance. For instance forwarding chain letters became popular, and many asked for donations of less than $1.

Mlm: Multi-Level Marketing

Some endeavors have a pyramid structure, but may or may not be pyramid schemes. A few popular legitimate MLM’s include Mary Kay, Avon, Advocare, and Plexus. Whether or not a MLM is a pyramid scheme, and thereby illegal, depends on whether or not there is a true product or service being offered.

In other words, if you cannot make money without recruiting a single person then it is likely a scheme. In the case of the examples listed here, each offers exclusive products and an agent of any of those companies can, in fact, make money without recruiting anyone. The catch comes in how good of a salesman you are. Any company that does not allow you to continue operating without recruiting is probably a pyramid scheme.

It is important to know how your money is being made. Whether that is through your 401K at the office, or though an online investment offer, always ask questions. Know where your money is going, and where your returns are coming from.

Pyramid Schemes

Be suspicious of missed payments, offers to ‘roll over’ your payment for the chance of greater returns, or promises of extra payments or higher returns for recruiting. If you believe that you are the victim of fraud or misconduct you can schedule a consultation with Albany investment fraud attorney.

Category: Consumer Complaints, Family Finances, Law