How to Increase Your Earning Potential with Bonds

To expand your earnings and prepare for a comfortable retirement, seek to invest your money in ways that will get you a higher interest rate of return. China is one of the superpowers of the world. Part of its rapid expansion is due to the fact that intelligent individuals throughout the country know how to manage and invest their resources.

To expand your earnings and prepare for a comfortable retirement, seek to invest your money in ways that will get you a higher interest rate of return. China is one of the superpowers of the world. Part of its rapid expansion is due to the fact that intelligent individuals throughout the country know how to manage and invest their resources.

Personal finance lessons can be obtained from the frugality of each successful Hong Kong wealth management bank. One of the powerful lessons obtained from these banks is the power of bonds in creating low risk, higher return investment opportunities.

Create Stable Growth with Bonds

If you are adverse to risk and want a very sure return, invest some of your money in bonds. Bonds are basically IOUs or promises of payment from private or public companies or from governments.

Generally, bonds are considered less risk than stocks because the bonds will pay the principal with a predetermined percentage of interest. In many cases, bonds will pay interest twice a year and will have a specific year agreement. After this period, the bond will mature and the bondholder will be able to access all the principle and interest that they have earned.

Corporate and Municipal Bonds

There are two major types of bonds: corporate and municipal bonds. Corporate bonds are issued from public or private companies. These bonds differ in their risk and return and can be either investment grade or high-yield. Investment grade bonds generally have low risk with a company demonstrating strong credit worthiness. If you want a higher interest rate than standard saving accounts and the lowest investment risk, obtain an investment grade bond. High-yield bonds result in more return and have more risk.

There are two major types of bonds: corporate and municipal bonds. Corporate bonds are issued from public or private companies. These bonds differ in their risk and return and can be either investment grade or high-yield. Investment grade bonds generally have low risk with a company demonstrating strong credit worthiness. If you want a higher interest rate than standard saving accounts and the lowest investment risk, obtain an investment grade bond. High-yield bonds result in more return and have more risk.

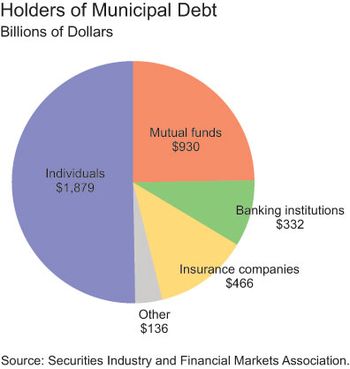

The second major type of bond is the municipal bond. These bonds are issued by a government organization like a community, state, or country. These bonds can differ dramatically in their risk of return.

Because some municipal bonds can be set up so that the issuer can legally stop paying the bondholder when certain conditions are met, it is critical that you know the different categories of municipal bonds.

General obligation bonds generate returns to bondholders based on taxation and not on the issuing government’s assets. Revenue bonds are not based on returns from a governments’ taxation but on the revenue associated with specific projects. If these projects stop generating revenue, then the bondholder can lose their investment.

A conduit bond is defined as a government issues bond on behalf of an organization like a hospital or college. These can have risk if the non-governmental organization fails to pay the bondholder, as the government might not assume the debt.

The Benefits and Risks of Bonds

Bonds in general pose much less risk than investing in stocks but have some drawbacks. The decreased risk and higher return than a saving account are the major benefits of investing your resources in bonds.

One of the drawbacks of bonds is that many require a long period in order to mature, which can tie up your resources while better investment opportunities emerge. Additionally, if you wish to withdraw your resources, you could face penalties that reduce or eliminate any return. Plan carefully, following the example of individual successful Hong Kong wealth management bank to generate the revenue you desire with your investments.

Category: Investing

Comments (1)

Trackback URL | Comments RSS Feed

Sites That Link to this Post