Funding University Fees

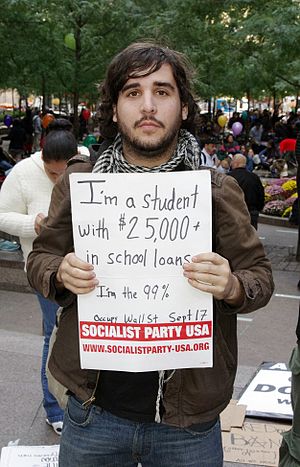

The rising cost of student loans and university fees means that it’s now more expensive than ever before to attend higher education establishments the in UK; today’s students have to pay around £9,000 on average for tuition fees, even before adding on the cost of accommodation and living. With this in mind, what are some of the ways in which university fees can be funded, and where should you look for advice on how to structure your finances for the future?

University fees are rarely out of the news, and those going to university have to accept that they’ll be tied down to a long term student loan if they decide to take it on to fund their course. To this end, there have been recent discussions about lowering the amount of loans that’ll simply be written out after 30 years by introducing more inexpensive £5,000 degree courses, with flexible course lengths and part-time learning.

Students that do take on a loan to cover their tuition fees and maintenance should be aware that repayments on these loans do not kick in until you’re earning over £21,000 a year; this means that you can go many years without actually contributing to your loan repayments. Once you do go over this threshold, interest on these loans are charged at 9 per cent, which means about £30 a month if you’re earning £25,000 a year.

While student loans are structured in such a way as to not create an instant burden, there are other options available for cutting down on the cost of fees; these include exploring university schemes and offers for hardship loans and bursaries, as well as setting up savings accounts well in advance of your child going to university. Junior ISAs, savings accounts, savings bonds, and fixed bonds might not generate much interest, but they can provide a regular way to put aside money.

Other, more extreme options for raising the funds for university fees include trying to unlock equity tied up in your home through a new mortgage – this can be a good idea if you’re able to commit to the repayments on a new mortgage, and want to use some of the cash that you’ve built up. You can also look into withdrawing against your pension scheme at an earlier date than expected.

With all these options, it’s best to weigh up the long term, but relatively small repayments held on a student loan against trying to cover the cost of education on your own. If you can create efficient savings systems for university, then you can reduce the risk of student debt hanging over someone for most of their life. Speak to an accountant or financial adviser to see what options you have available to you; similarly, consider how students can lower their living costs while at university through part time and summer work.

Author Bio

Rosette is a former student of Lansdowne 6th From College. She knows that as a prospective university student you need to research well your financial options before leaving home to study a degree.She can be found blogging about various aspects of student life.

Category: College