Diversify Your Portfolio: Five Proven Investment Strategies

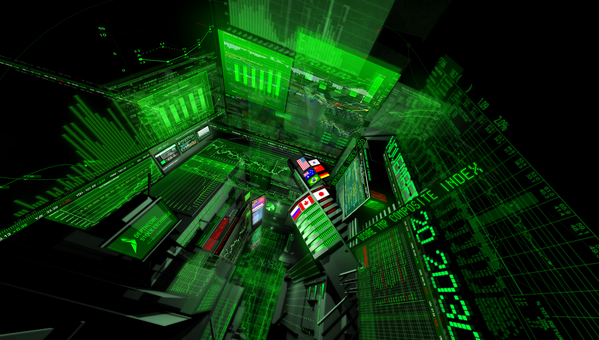

With so much instability and uncertainty in the global economy, everyone seems to be looking for an investment that can help them to make money without a lot of risk. While these five investment strategies aren’t guaranteed, years of experience have shown that they work.

With so much instability and uncertainty in the global economy, everyone seems to be looking for an investment that can help them to make money without a lot of risk. While these five investment strategies aren’t guaranteed, years of experience have shown that they work.

1. Buying and Holding Dividend-Earning Stocks

This is one of the classic ways to make money. For it to work, you’ll need to pick stable, established companies that have consistently offered a dividend to their investors. Hold on to the stock at least long enough to make your money back off the dividend before you consider selling.

2. Foreign Currency in Emerging Markets

Emerging markets are typically in countries that are entering into an industrial era. This typically occurs after a period of political unrest. By purchasing currency immediately after a political incident, its price is deflated. Sell when the country becomes stable and profitable. For example, the latest dinar news indicated that now is a good time to buy dinar, then hold onto the currency as Iraq continues to stabilize.

3. Mutual Funds

This is a great investment for beginners. Costs are low, and picking a mutual fund that tracks a wide range of stocks can give you a lot of exposure to different industries. This means you’ll be able to make money as long as most industries are doing well. It’s also fairly easily to liquidate your holdings, and there are virtually no maintenance costs. Furthermore, experts manage the investments themselves, so you don’t have to worry about making decisions on a daily basis.

4. Government Debt

Many new investors tend to think about buying federal debt (such as savings bonds), but there are a lot of opportunities in the state and city-level markets. Interest rates tend to be less than six percent, but buy-in costs are low. Furthermore, this type of investment has been thought of as one of the most stable and secure investments a person can make for decades. That means this can be a good way to stash cash while deciding on your next investment, or a good way to make a portion of your portfolio stable while earning income. Of course, recent economic problems have made some cities default on their debt, but these are seen as isolated incidents. Nevertheless, it’s a good idea to buy bonds from multiple sources.

5. Real Estate

While buying and flipping properties was never really meant to be more than a niche market, there are great returns for people are willing to buy and hold properties. Renting out single family homes is a way for an individual to start, but many investors choose to put their money into an REIT. These investments buy a wide range of properties, including residential, commercial, and industrial, and rent them out. Profits come from both the rent and again when it comes time to sell.

While there are plenty of investment strategies out there, these five methods have a proven record of making money. By choosing wisely and holding onto your investment through the rough times, you’ll be able to make money.

Category: Investing