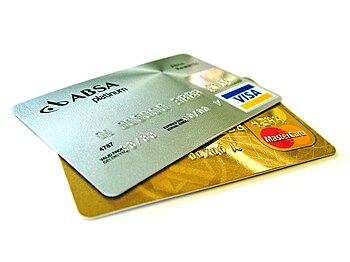

Credit Card

Credit Card

Laid Up? How To Get Those Loan Payments Deferred

No matter how much money you make on an annual basis, you could easily find yourself in financial trouble if you become injured due to an accident or unexpectedly laid off work. Therefore, it is essential to take proactive steps to protect yourself and your credit rating, just in case you end up dealing with […]

Selecting the Right Credit Card According to Your Needs

A credit card when used wisely is a great tool in properly managing your finances. Most of these cards come in a variety of identity theft protection, travel insurance and cash backs or rewards. You can check with your local bank for cards that are available in the market today. You can also research about […]

How to Use 0% APR Credit Cards to Your Advantage

Have you ever been shopping for something and when you checked out they offered you 6 months same as cash financing? That is what 0% APR credit cards offer, except it is for all of the purchases that you make on your card. 0% APR credit cards allow you to make all of the purchases […]

Important Reminders for Using Your Credit Card Abroad

Carrying cash can be a source of stress and traveller’s cheques outdated so it’s only natural that businesspeople and holidaymakers use their credit cards abroad. There are, however, a number of considerations you’ll need to take into account if you plan on using your credit card abroad, including having cash or a traveller’s cheque on […]

3 Insider Tips for Paying Off Your Credit Cards

Even if you aren’t currently carrying a balance on your credit cards, there are a number of helpful tips and tricks that could prove useful to you in the future. Here are three tips everyone should know about credit card interest and making payments to get rid of credit card debt. Start by Paying the […]

Take a Look at a Balance Transfer Credit Card to Consolidate all of your Credit Card Debt and Save Money

Now that the holidays are over you may be looking at some pretty hefty balances on your credit card statements. And if you are one of the people that took advantage of store branded credit cards then you might also be looking at paying a decent amount of interest as well. But what if […]

Credit Card Fraud: 4 Ways to Protect your Business

There are several difficult aspects to running a company, and unfortunately, many business owners quickly find out that credit card fraud is one of these potential difficulties. Credit card fraud occurs when an individual uses another person’s debit or credit card without obtaining their permission or uses a card that isn’t valid or that has […]

5 Tips to Finding the Right Merchant Account Service for Your Small Business

When business owners decide to take on credit cards as part of the payment options on offer for their products and services, they usually do so from popular banks under the misguided impression that this is their only option. Banks tend to capitalize on this misconception by charging rates that are a rung above acceptable […]

What You Must Check While Selecting PPI Claim Settlement Company

Recently, payment Protection Insurance or PPI has been mis-sold often and people are finding it difficult to get their money back. Anyone who had taken a loan, mortgage or even a credit card were either forced to buy the PPI or sold to them without their knowledge. The purpose of selling this insurance plan by […]

Follow Us!