Buying Used Cars Provides the Best Value

There are numerous methods to buy a new car these days and with all the incentives each one promises, it can be hard working out which provides the best value. Depending on your situation certain methods may be more appropriate but usually purchasing a used car is the best choice.

There are numerous methods to buy a new car these days and with all the incentives each one promises, it can be hard working out which provides the best value. Depending on your situation certain methods may be more appropriate but usually purchasing a used car is the best choice.

This holds something over each of the other options for financing a fresh vehicle and results in the best return for you.You may find out that buying used cars may be your best option.

Buying New

The main reason for avoiding buying a brand new car is the price tag. Added to that, new cars quickly depreciate in value, which means a lot of your initial expenditure soon disappears. Used cars obviously come with a much lower price tag and won’t depreciate in value anywhere near as much.

There can also be an extra risk purchasing a brand new vehicle. As with anything new it won’t have much real world experience and unknown faults may soon come to light, resulting in a lot of wasted money. At least with a used car you know any initial faults will have hopefully been fixed.

Leasing

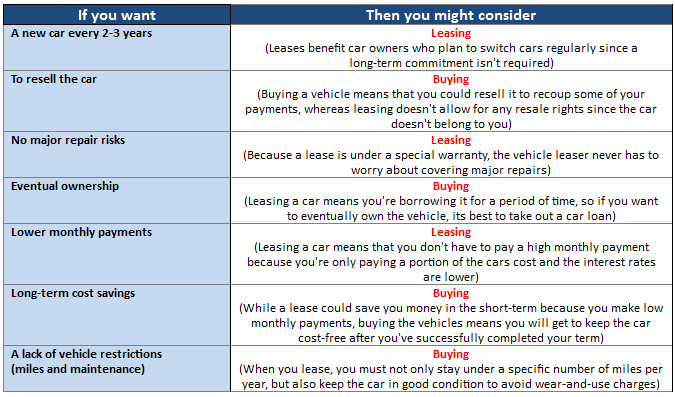

Leasing a vehicle provides an extremely convenient option for anyone after a brand new car. This avoids losing money through the vehicle’s depreciation value as you don’t actually own it. However, this does mean after the lease is up you are left with nothing to show for it.

A monthly payment plan is created so you can afford the car but these can be fairly costly as servicing and maintenance charges aren’t included. Sometimes this works out more than buying and paying bills on a used car separately.

Buy vs. Leasing

Personal Loan

Taking out a personal loan is another method for affording a new car (or sometimes a flashy used one). It is quick to sort out and allows you to purchase the vehicle so you have the asset. You will have to pay interest when making repayments which, when considered, means you pay above the odds of the car’s value.

Hire Purchase

Hire purchase has become a far more popular method of securing a car in recent years as it combines many traits of leasing but you end up owning the vehicle in the end. You still lose out with the added interest attached to each repayment rather than buying a used car outright though. Plus you don’t own the car until the final payment is made, by which time it could have lost a lot of value.

One thing is for sure. You have lots of choices when purchasing a car. Do the math first before you make any decisions.

Category: Car Purchase