5 Big Tax Breaks That All College Students Should Know About

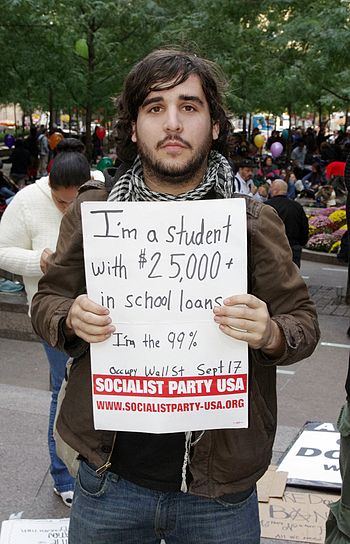

English: Day 3 of the protest Occupy Wall Street in Manhattan’s Zuccotti Park. (Photo credit: Wikipedia)

Saving money in college is a big deal. Whether you’ve managed to nab scholarship funds, your parents are helping you out, you’ve taken out student loans, you work a part-time job, or all of the above, money is likely to be a little tight during your years in college thanks to the high cost of tuition, books, and living expenses.

So eating out and shopping sprees are probably not activities you’ll participate in much until you earn your degree and start your career. The stereotype of the starving college student didn’t come from nowhere, after all, so it behooves you to pinch pennies as you obtain higher education.

Of course, you may not know about all of the ways in which you could save. And if you’re not taking advantage of tax breaks for students, you could be missing out on some major monetary relief. Here are just a few tax benefits that every student should know about.

- American Opportunity Tax Credit. The first thing you need to know about this credit is that you are only eligible to claim it if you are filing your own taxes. So if your parents claim you as a dependent, you’re out of luck. And you should also be aware that this portion of the Education Tax Credit is reserved for students working towards a degree and can be used during your first four years of college.But if you meet other criteria, such as earning less than $80,000 per year (or $160,000 if married) and paying at least $4,000 per year in applicable tuition and fees, you may qualify for a $2,500 credit. And if it turns out that you owe nothing on your taxes, you could still get $1,000 back, so it’s definitely worth claiming the credit if you can.

- Lifetime Learning Tax Credit. This section of the Education Tax Credit applies to students that are in the working world and engaging in continuing education, which is to say, coursework that is related to their job. If you are eligible for this credit you can claim up to 20% of the money spent on tuition and fees for a credit of up to $2,000. However, you must earn less than $52,000 per year (or $104,000 for married couples).

- Tuition and Fees Deduction. This tax credit is expiring, but it can still be claimed (up to $4,000) for the 2013 tax year, so if you paid your spring tuition before December 31st, you’re in luck. What’s nice about using this deduction is that either students or their parents can claim it. So if you’re still a dependent, your folks can get the tax break on your behalf. You’ll need to talk to your tax prep specialist to determine whether or not you can take this deduction in concert with the Education Tax Credit (American Opportunity or Lifetime Learning), and if not, which is likely to offer you the best return.

- Student loan interest deduction. Although most students won’t start paying off their student loans until they graduate, you might be interested in getting ahead of the curve and earning a write-off in the process. It turns out that you can claim a deduction for up to $2,500 per year in interest paid on your student loans. At the very least, you should be aware of this write-off for when you graduate and you have no choice but to start paying off your loans. Whether you spend beaucoup bucks on a fancy education from Harvard or Pepperdine or you opt to take online courses from the comfort of home, you will eventually have to start paying down debt, and any financial advantage you can gain should be on your radar.

- Mortgage interest deduction. There aren’t too many college students that own a home, but if you are lucky enough to find yourself in this position you should know that you can gain a huge advantage by writing off the interest from your monthly mortgage payment. It’s not something that every student can claim, but you should be aware of the fact that there are all kinds of deduction, credits, and incentives out there that you can take advantage of as a student, and not all of them are related to school.

Category: Education